Why Stock Markets Keep Going Higher

Two weeks ago, I introduced you to the reason President Trump does not talk about federal deficits or the national debt. Very simply, his reason is that as long as the American people and their government are forced by that same government to use dollars, borrowed at interest from private Federal Reserve member banks, and use that currency as legal tender, sustaining a balanced annual budget without borrowing, or paying off the national debt, is mathematically impossible. Trump doesn’t talk about things that are impossible, only things that are possible.

Last week I elaborated on what I told you before, referring to the Federal Reserve’s own publication entitled, “Modern Money Mechanics.” In that document, the Chicago Fed explains how dollars are created and who creates them. That document exposes the fact that before a Federal Reserve dollar can be created, a regional Federal Reserve Bank, such as the New York Fed, must take in collateral in the form of U.S. debt, in the same value of new dollars issued. The New York Fed, in turn, releases those dollars and deposits them in accounts of U.S. debt sellers in one of the New York Fed’s member banks on Wall Street. In my example, I chose Goldman Sachs to be the recipient of the deposited funds.

Once those newly-created dollars are deposited into Goldman Sachs accounts, we discovered that Goldman is free to issue its own brand-new dollars in amounts up to nine times the amount deposited. In last week’s example, I chose a $10,000 U.S. T-Bill as the collateral (or “reserves” as the system refers to them) held by the New York Fed, resulting in another $90,000 Goldman Sachs can legally create to either loan at interest into circulation, or very importantly, to invest for its own benefit. That is what the Chicago Fed tells us on page 3 of MMM, “In the absence of legal reserve requirements, banks can build up deposits by increasing loans and investments so long as they keep enough currency on hand to redeem whatever amounts the holders of deposits want to convert into currency.”

So now, let me take you back to 2008-9. Remember the financial crisis from 10 years ago? Yes, that one. What really happened there? What happened is that by abusing the system I just described, the Federal Reserve banking system, led by those banks on Wall Street under the auspices of the New York Fed, committed death by chocolate. They over-imbibed. Collateralized by U.S. debt held at the New York Fed and others around the country, those banks created so many dollars, completely out-of-the-air, and loaned them into circulation in so many questionably-qualified deals, that when the loans could not be paid back, the banks, denied of substantial monthly cash flow, could not remain within their own 10:1 loans-to-deposits requirements. Starved of liquidity, the Federal Reserve Banking system, led by the Banks on Wall Street, died. Yes, the private banking system that issues American currency died. It was gone. It would not be able to come back on its own.

And so, what did the U.S. Government do? Rather than doing the right thing by the American people and placing the Federal Reserve System under receivership, and in the process restoring rightful ownership of the American currency to the people through the U.S. Treasury Department, Congress passed the Troubled Assets Relief Program, TARP. TARP allowed the bankrupt banks on Wall Street to issue almost $800 billion dollars, created out of thin air, loan it to the American people through the U.S. Treasury Department, and the U.S. Treasury gave it back to the banks to bail them out.

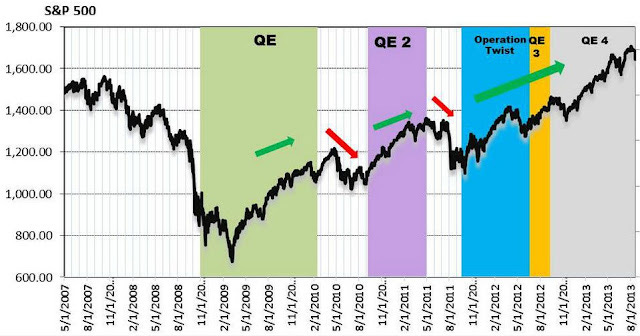

But TARP was not enough to bail out the system. Even after an infusion of $800 billion into the coffers of the remaining Wall Street Banks (two were sacrificed), there was not enough liquidity in the system to loan sufficient dollars into circulation to keep the American economy going. Not a problem. That is when the Federal Reserve Central Bank in Washington, D.C., the so-called lender of last resort, commenced to money printing. They gave that process a technical name to make it sound legitimate, calling it “quantitative easing,” remember that? QE was a program in which the central bank, run by Fed President Ben Bernanke, over time created almost $4 trillion dollars, out-of-the-air, using those dollars to buy up bad debt still non-performing on the books of Wall Street banks, but also very importantly, using it to buy up newly-issued U.S. debt. After all, if there is not enough money floating around to keep the economy going, no one will be buying U.S. debt with surplus.

And so what happened next is amazing. Each time a new round of QE began, stock markets went up like rockets. Each time a round ended, markets tanked. Why did that happen? Recall what we just read on page 3 of MMM. With each new cash infusion from the central bank, taking bad debt off Wall Street books, the banks in receipt of new funds had an option, either loan new dollars into circulation using a 10:1 ratio of loans to deposits, or importantly, invest those dollars for their own benefit. So each time a new round of QE ramped up, markets went up like rockets. And today, as the U.S. Government issues more and more debt, based on the process I just described, stock markets keep going higher and higher. That is why. Next, the Fed Balance sheet…