Continuing with my recent series on the Federal Reserve, what it is and who it represents, next you should know that the Boards of Directors for the Federal Reserve Banks in each respective region are elected by the member banks of that region. That makes sense because those member banks OWN the regional Federal Reserve Banks. According to the corporate model, shareholders elect board members, the Fed member banks are the shareholders, so there you go. And the larger a member bank might be, the larger is its vote on who runs the show at the level of the Federal Reserve region. That said, let's take a look at the Board of Directors at the New York Fed. That is where all the collateral (US Treasury debt) backing the issuance of base currency is held. That is where the Fed’s Balance Sheet is maintained.

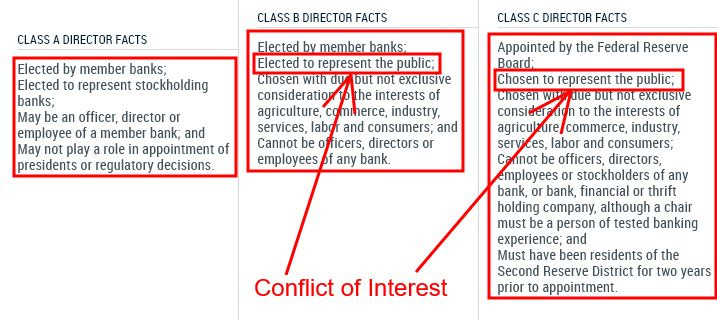

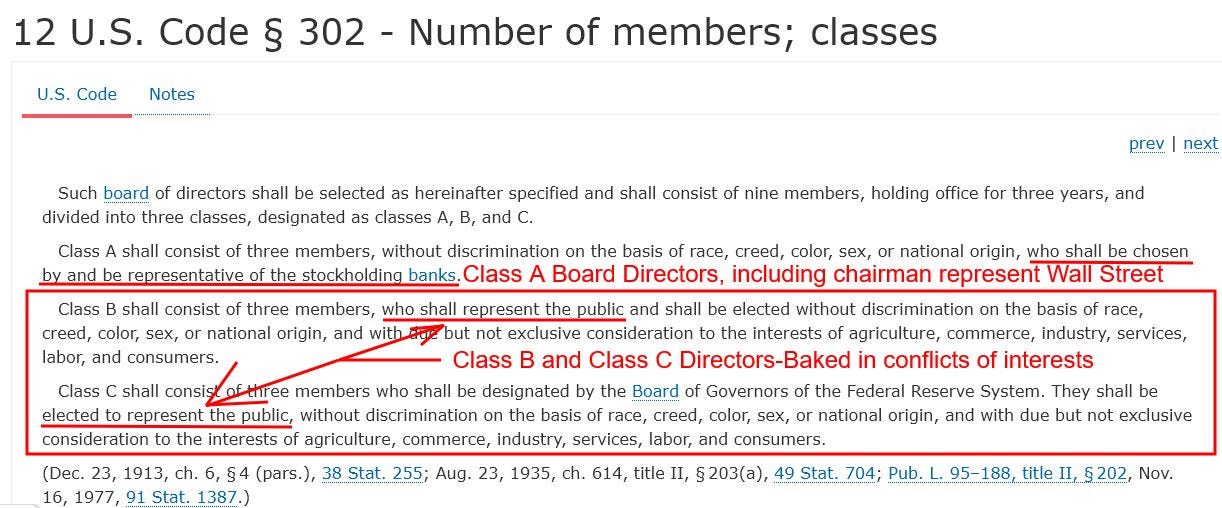

The Federal Reserve Act creates three different classes of board directors, Class A, Class B and Class C. Regarding the NY Fed, the Class A directors, including the Chairman, unabashedly represent the banks of Wall Street. The Class B Directors, who as you see below, are CEO's of major multi-national corporations, but ostensibly are there not to represent the corporations who write their checks, but instead the public at-large. And the Class C Directors are executive officers of two large non-profits and the AFL-CIO labor union, also officially assigned the task of representing the public.

Thus, within the New York Fed board we have built-in, multi-faceted conflicts of interests regarding both the Class B and C board members. The first loyalty of Class B board members is of course to the major corporations for which they make executive decisions. But of course, these corporations rely heavily on financing from Wall Street banks, the representatives of which are the Class A board members. And the organizations for whom the Class C board members work rely heavily on either donations from Class A and B organizations, or work directly with the Class B corporations, as is the case of the AFL-CIO.

So all of this is a ruse. There is no real representation of the public-at-large on the Board of the New York Fed. We should expect that because the New York Federal Reserve Bank is privately-owned by the member banks of that regions. Thus any consideration beyond maximizing the profits of those respective member banks would be in conflict with the fiduciary responsibilities of each board member, not only under the law, but also the self-interests of the board members. One cannot serve two masters. But serving two masters is what the authors of the Federal Reserve Act would have us believe these board members are there to do.

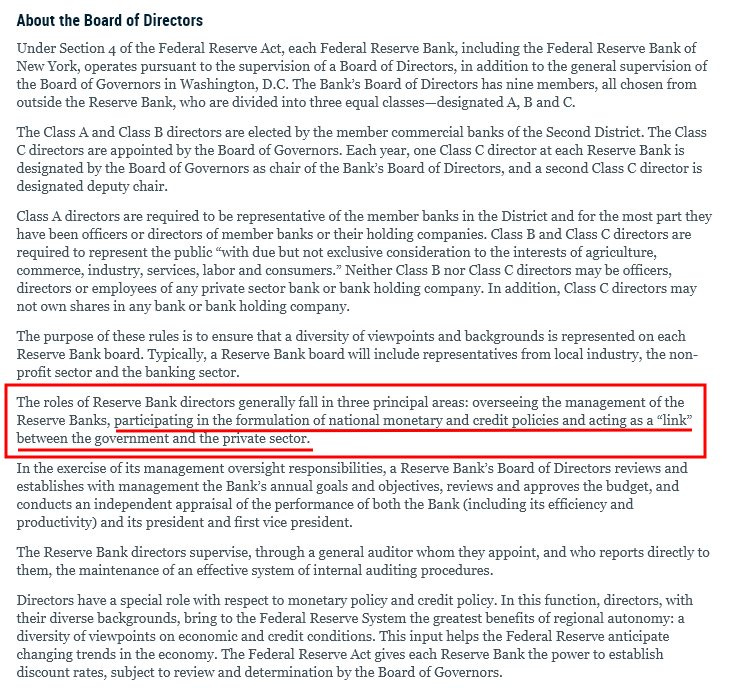

Next, I want to direct your attention to one paragraph under the heading of "About the Board of Directors." That paragraph states:

"The roles of Reserve Bank directors generally fall in three principal areas: overseeing the management of the Reserve Banks, PARTICIPATING IN THE FORMULATION OF NATIONAL MONETARY AND CREDIT POLICIES AND ACTING AS A "LINK" BETWEEN THE GOVERNMENT AND THE PRIVATE SECTOR."

Let's unpack that for a minute. First of all, there has always been a question regarding the reason Congress rarely discusses US monetary policy. The answer is that Congress has no power over our nation's monetary policy, only fiscal policy. When Congress passed the Federal Reserve Act in 1913, they established a private corporate consortium, placed its board of directors WITHIN the US Government, insulated that board from the US Government, and placed the operational control of this consortium in the hands of the private member banks of the system via board members who they elect. In so doing Congress essentially placed the control over monetary policy, just inches beyond its own reach. I say, 'just inches,' because Congress could change that at any time, but it would take a new act of Congress to do it.

Secondly, the presence of private boards of directors having any impact at all over our nation's monetary and credit policies, creates a special relationship between the private banking institutions under their control and the US Government. It changes our form of government away from a constitutional republic, to one more accurately referred as a "corporate-fascist state." I define corporate fascism as:

"a system by which the people’s government, over time, becomes so heavily influenced by corporate special interests, interests who have the means necessary to purchase influence at the very highest levels of the people’s government, that the government is for all practical purposes, eventually taken over by those corporate special interests. At that point, the government becomes effectively a tool to promote the purposes of those corporate special interests."

Thus, as I quoted from the NY Fed website above, there is a purpose for these regional boards to "act as a link between the government and the private sector." For the reasons I provide, that "link" can be better understood as ultimate control over the nation's money supply, which parties receive primary benefit, how much benefit they receive, where funds are channeled, both overtly and covertly, the policies under which those funds can be channeled, and therefore the control over the enslavement of the users of the system, which include both the American people and even their government.

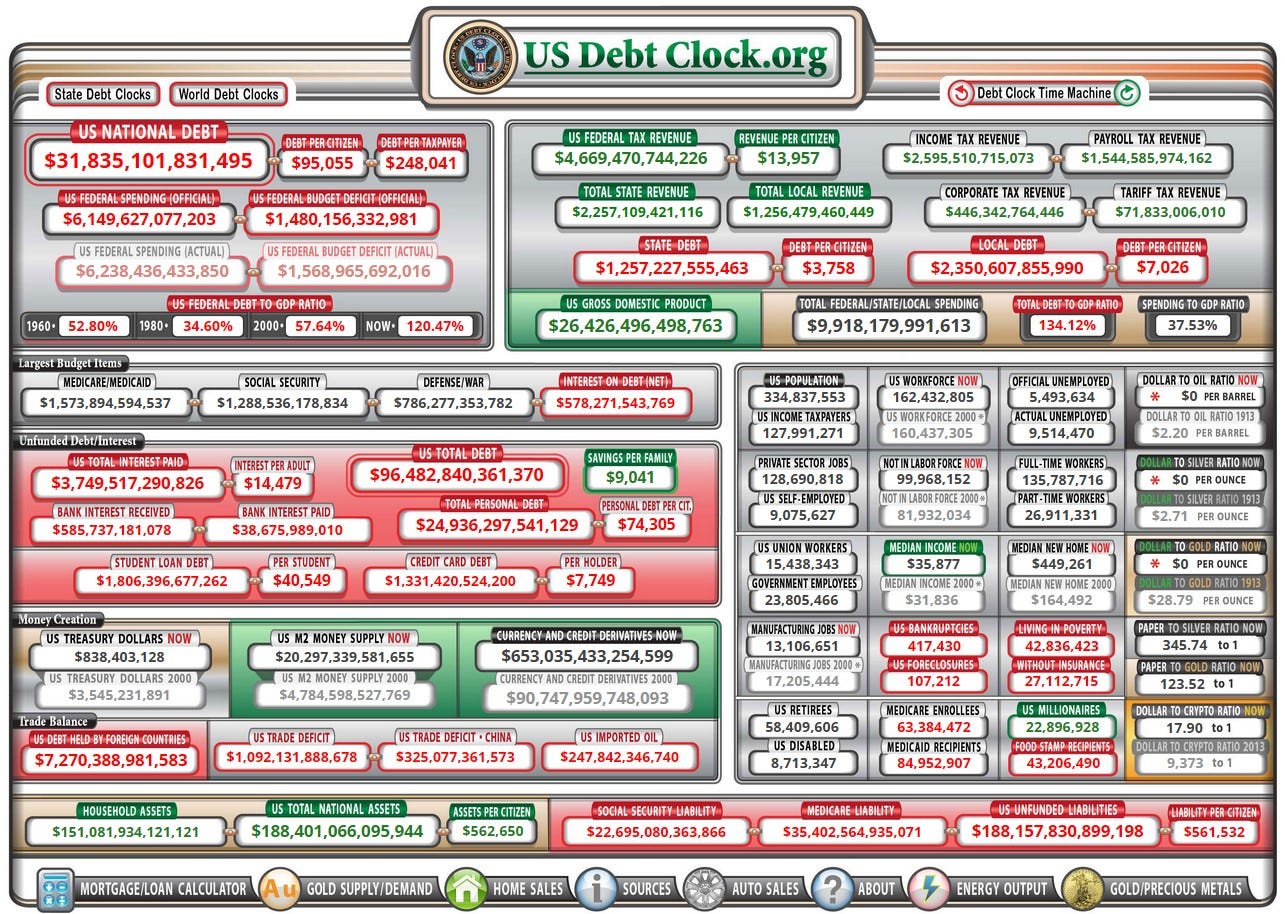

Regardless of the fairy tale the Federal Reserve Act offers as to certain interests being served by board members pretending to act on the public's behalf, corporate responsibilities require those private Federal Reserve board directors to first satisfy the interests of the member banks and corporate entities who write their checks, and whose corporate mission statements intimately align with the financial interests of the banking system, all of which fall under their care and supervision. It is unavoidable that each of these board members know exactly what this system is, and that it is working to promote the ultimate purpose of continuously transferring the wealth of the American people, as they generate it, to the banks of the Federal Reserve System, indebting the people and their government as it does, utilizing operations which have over time resulted in the massive and unpayable national and private debts of the American government and the people it was originally designed to serve, as the National Debt Clock continually reminds.

Awesome column. Truth