Vivek Ramaswamy at the Georgia GOP Convention

Vivek Ramaswamy “tore up” the Georgia GOP convention last week. I give him credit. He gave a great speech. Republicans talked about Vivek all weekend. I don’t know anyone who wasn’t impressed, even delighted, with Ramaswamy’s speech. But, to me, it was unsettling that someone I had never heard of six weeks ago, could arise from the ether, be handed the stage at the Columbus convention, and overwhelm an audience as he did.

It was unsettling because the last individual I saw do that was a young man by the name of Barack Obama, who, similarly, arrived out of nowhere, known by only a few insiders, was handed center stage at the 2004 Democratic National Convention, and likewise “tore it up.” Four years later Obama became a senator from Illinois. Four years after that, Obama became President of the United States. We know what happened since.

Thus, to say that I was a little apprehensive about Mr. Ramaswamy would be an understatement. I decided to look into the man. Who is V. Ramaswamy? What is his story? How did he get all that money at age 37? What is his motivation? And why has he decided to run for president, especially now? I had certain suspicions. What I found out was different than I originally imagined. So I hope you will come along with me as I take a deep dive into Vivek Ramaswamy to see what we can learn.

Education and Early Career Experience

Vivek Ramaswamy is, or at least appears to be, a highly successful, 37 year old entrepreneur. By some estimates, he is worth over $600 million, by others, not so much. Born and raised in Ohio to parents who emigrated from India, at age 22 he graduated summa cum laude in Biology from Harvard. Soon after graduating, however, rather than pursuing a career in his chosen field, Vivek pivoted, starting a career as a biotech analyst/investor at QVT Financial, a prominent hedge fund.

With his only credential an undergraduate degree in biology, at the time Vivek Ramaswamy began his job managing hedge funds, he had no time or experience, no certification, no formal education of financial markets, no experience in portfolio management, or asset allocation expertise. The extent of Vivek’s involvement in hedge fund management came to him by virtue of two summer internships while at Harvard. The 19 year-old biology major spent his first summer interning with a since-defunct nine-billion-dollar hedge fund, Amaranth Advisors. Looking back, Vivek would tell interviewers he opted interning at the hedge fund over biology because, “the thought that working in the firm’s biotech division, where a team of doctors and scientists evaluated stocks for the firm to invest in, might be more exciting than working in a lab.” Thus, according to Vivek, he makes decisions based on certain hope for excitement.

The second summer Ramaswamy spent interning at Goldman Sachs, where he had little in the way of responsibility, little or no hedge fund investment training, and worked in an environment he later referred as, “a charade,” New Yorker Magazine reporting,

He (Ramaswamy) describes the inner workings of the firm as a charade, with jaded bankers in hand-tailored dress shirts doing little while making a show of how busy they were. He was especially struck by what was often called Service Day, when employees engaged in volunteer projects around the city. One day, he recalled, he and some co-workers gathered at a park in Harlem for a tree-planting session. A Goldman boss showed up in Gucci boots, told the employees to take photographs to document their presence, and then split. The group reconvened shortly afterward at a bar.

So, there you have the extent of Vivek Ramaswamy’s knowledge and experience in investing and managing hedge funds prior to taking a job doing just that at QVT.

Despite a lack of formal training in financial matters, while managing QVT investments lightening struck twice for the rookie hedge fund manager. In 2008 he began a program of buying shares of a little known biotech company, Pharmasset, at $5/share. Three years later, Pharmasset would be purchased by Gilead at $137/share. As one of the largest Pharmasset shareholders by then, QVT did very well. Vivek worked his magic a second time purchasing another small but promising company, greatly profiting QVT and becoming a partner in the firm as a result. Was that skill, or was that luck?

Either way, managing hedge funds did not prove as exciting as Vivek first imagined. To stimulate his demanding intellect, in 2010 while still working at QVT, with the company’s blessing Vivek began moonlighting as a student of the law at Yale University. After three years, Vivek earned his degree, completing a personal project he would later claim he undertook purely “for the intellectual experience,” graduating in 2013 at age 28. To help pay for his intellectual experience, Vivek took advantage of a $90,000 scholarship from The Paul & Daisy Soros Fellowships for New Americans. Who is Paul Soros? Paul is George Soros’ brother. Does Vivek have a relationship of some sort with the Soros family? We don’t know, but before announcing his presidential bid, concerned that any relationship with Soros would tarnish his image, Vivek paid a Wikipedia editor to remove references to Soros, the edits completed two weeks prior to his announcement.

Thus, we know young Vivek Ramaswamy was a brilliant Harvard biology student, who never worked a day in biology. And we know he was at least a competent Yale law student, who never took the bar exam and never practiced law, and who paid for his degree out of money received from George Soros’ brother. Finally, we know Vivek gets bored easily, always looking for the next big thing to excite his senses and stimulate his intellect.

Starting His First Company

Instead of pursuing a career in law, within a year of graduating Yale, Vivek Ramaswamy opted to put his talents to work in a field in which he had no training to speak of, and no experience, and very little apparent knowledge, the pharmaceutical industry. He founded Roivant Sciences in 2014, to be a pharmaceutical holding company, serving as its CEO until 2021. Vivek had the idea of taking drug formulations previously shelved by major pharmaceutical companies, establishing various corporate subsidiaries to to conduct additional research, undertake clinical trials, and if successful bring those drugs to market, precisely the kind of activity that could excite Vivek’s sensabilities, at least for a while.

Although Vivek had no experience running a business at any level, somehow he capitalized Roivant in an IPO, raising $93 million from investors. And somehow, he recruited several well-known Democrat figures to become board members, including former Senate Majority Leader, Tom Daschle, former Secretary of Health and Human Services under President Barack Obama, Kathleen Sebelius, and former administrator of the Centers for Medicare and Medicaid Service, Donald Berwick.

The first drug Vivek attempted to bring to market was one previously shelved by GlaxoSmithKline, one engineered to treat Alzheimer’s and other cognitive disorders, for which he bought the rights to further develop, investing $5 million. Vivek established an offshore entity in Bermuda, Axovant, to own the formulation and perform the work, subsequently capitalizing Axovant in the largest IPO ever undertaken, immediately raising over $300 million for the project. That was a remarkable amount to raise considering Axovant had no marketable product to sell, only the hope of developing an effective treatment for Alzheimer’s, a successful drug in that regard one of the the Holy Grails of pharmaceutical research. Thus, right off the bat Vivek Ramaswamy went for the brass ring which others, better capitalized and more knowledgeable, had always fallen short of grasping.

It is difficult not to notice the amount of unnatural, unfounded trust investors consistently place in Vivek Ramaswamy. He had no training in business, not even a childhood paper route, had never worked in business so much as a bag boy for a local grocery store, yet as he navigated various career paths, investors jumped at the chance of allowing him to manage their hedge funds, and to give him money to start a business tasked with developing a long shot drug the initial developer, with deep pockets and the experience of GlaxoSmithKline, decided would never pan out. Vivek thought differently and convinced investors to have faith in what he told them. So they gave him all that money based on a hunch. Quoting the New Yorker,

“Forbes (magazine) put Ramaswamy on its cover and called him ‘The 30-Year-Old CEO Conjuring Drug Companies from Thin Air.’ In the accompanying article, Ramaswamy declared, “This will be the highest return on investment endeavor ever taken up in the pharmaceutical industry.”

Vivek Ramaswamy ran the worth of Axovant up to a reported $2.6 billion, only to be told the devastating news, the Alzheimer’s drug was just as Glasko figured, a failure. As a result, Axovant investors lost all of their money. Vivek told an interviewer, “It felt humiliating…I’d let people down. I took it hard.” Yes, Vivek may have taken it hard, but importantly, Vivek lost no money, himself. As CEO of the parent company, Vivek continued to receive his compensation while Axovant went bankrupt, his investors left with nothing.

Vivek’s Companies Generally Lose Money

For all his touted success, Vivek Ramaswamy’s companies, led by flagship Roivant, generally operate at a loss, Fortune Magazine recently reporting,

His flagship holding company, Roivant, has never once turned a profit since going public, losing $433 million in 2020, $698 million in 2021, and a whopping $1.12 billion in 2022, with Bloomberg predicting another $1.03 billion in losses in 2023.

Despite losses in his companies, according to his tax returns, Vivek does reasonably well, Politico reporting Vivek declared, “over $1 million in annual income for the first time in 2011, when he worked at QVT Financial, and has since reported earning more than $240 million, driven by $174 million in capital gains for 2020.”

Having built a personal fortune despite the unprofitability of his companies, Vivek ultimately decided to move on from Roivant day-to-day operations. In early 2021, either voluntarily or forced by the board, Vivek Ramaswamy stepped down as CEO, once again turning his attention to something else, constantly searching for excitement and the next big thing.

Striving for More Excitement

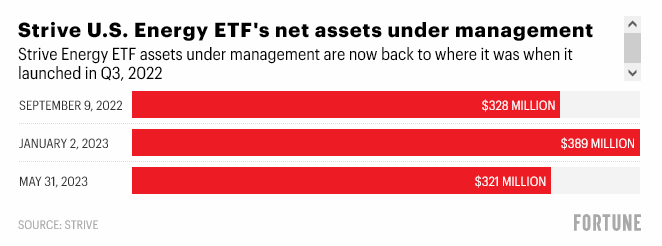

When one’s companies are not doing well financially, what should one do? For Vivek Ramaswamy, the answer seems always to start another company. No longer inhibited by the chore of continuously marketing a languishing biotech company to the world, in the third quarter of 2022, Ramaswamy announced the establishment of his latest source of excitement and intellectual stimulation, Strive Asset Management. Strive represents a new direction for Ramaswamy, a pivot toward ideologically-based financial management. Designed to compete for investors by differentiating itself from corporate “wokeism,” Strive’s allure is the prospect that politically conservative-minded investors might believe conservative-minded asset managers will better invest their money than woke managers. Is the business plan working? So far, no. Competing against the likes of Blackrock, Strive’s market presence hardly measures. Approaching the completion of its first year in operation, Strive’s assets under management (AUM) are virtually unchanged and appear to be trending downward, in the red over $60 million since the start of 2023.

Why Vivek Ramaswamy is Running for President

Strive may be Vivek’s last chance at notable, mid-scale entrepreneurship. Having failed, or at best stagnated in every capitalized venture since his days at QVT, Ramaswamy’s strategy appears to be ginning business for Strive by becoming a politically-active personality in the 2024 presidential race, which he must know he has very little chance to win. To announce his intention, earlier this spring the charismatic Ramaswamy appeared on Fox News’ highly rated Tucker Carlson Show, declaring his run for the Presidency of the United States.

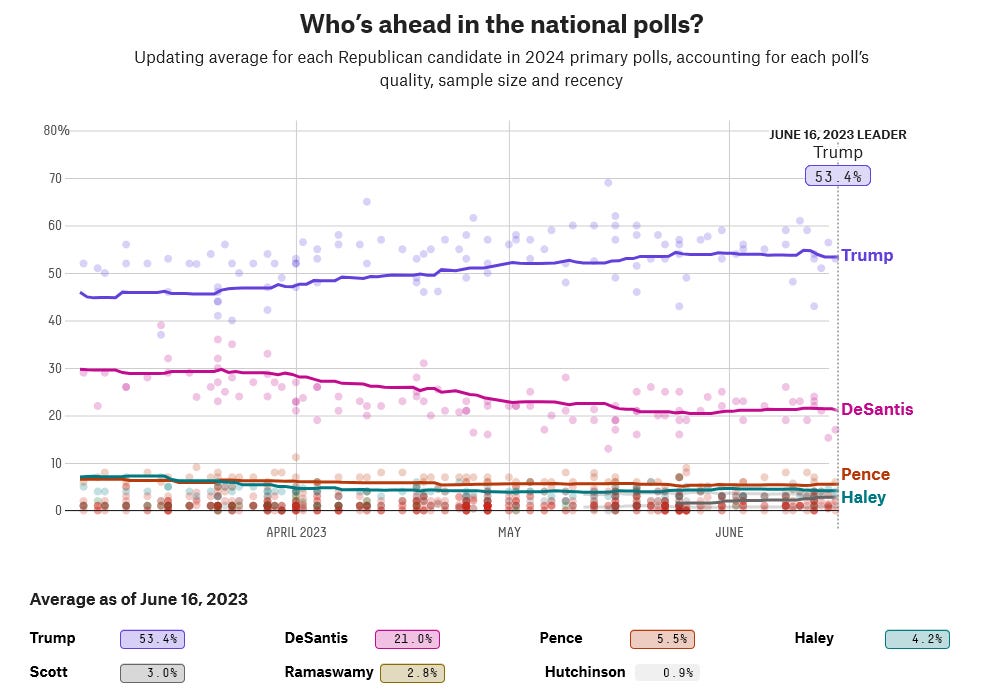

Polling at under 3% among Republicans, a level which does not register on the graph below, conservative support for Vivek Ramaswamy appears to be decreasing as rapidly as Strive’s AUM.

Obviously, a candidate polling in 6th position, next to last, against all challengers to a popular, well-funded, previous president, will have a difficult path to navigate to occupy the Oval Office. That being the case, why is Vivek Ramaswamy running for President? Two reasons appear obvious. First of all, Vivek Ramaswamy bores easily. As he has told us and demonstrated many times, Vivek craves excitement. A presidential run excites him. But secondly, Strive may be his last chance at success in the Wall Street level financial world. Vivek sees a presidential run as a way to energize a company in search of a politically-conservative clientele. Vivek Ramaswamy knows he is not a serious contender to become President of the United States, at least not anytime soon. Therefore, the only motivation remaining would be just that, to use a presidential run as a source of personal excitement, and to lure conservative-minded investors toward his conservative-minded asset management company. There you go.

Vivek Ramaswamy’s Mistaken Political Beliefs

In a recent tweet, Vivek Ramaswamy offered a video explaining his interpretation of the principles of America’s founding, which he claims are responsible for safe-guarding human freedom. Here is the truth Vivek proposed to his audience:

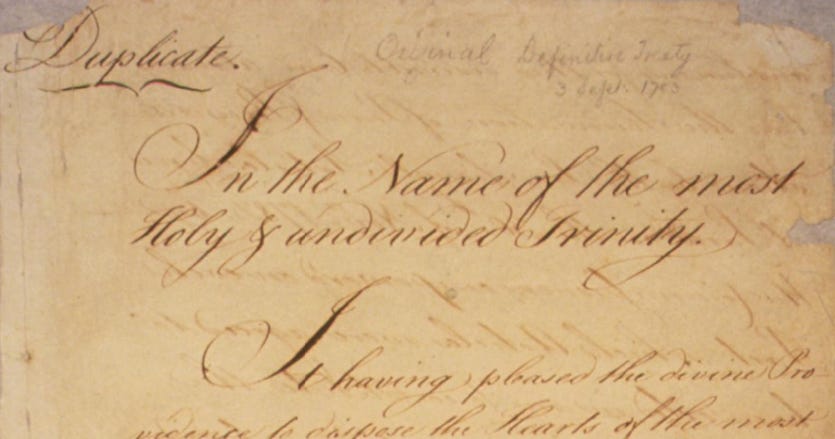

But in his speech, Vivek proposed a truth which is not what Thomas Jefferson knew at all. Neither Jefferson, nor any of our founding fathers, would agree that freedom depends on a belief in some generic, undefined higher power. Jefferson and America’s founders professed faith in the power of “the most Holy and undivided Trinity,” and that it is that specific higher power Who has the capacity to free mankind, none other. In fact, our founders would agree that any other proposed higher power would be purposed toward the enslavement and destruction of mankind.

Vivek Ramaswamy professes Hindu faith. He has every right in America to do so. However, the “laws of nature and of nature’s God,” as Thomas Jefferson wrote in the Declaration of Independence, and to which Vivek refers, are not the laws of any Hindu gods, Brahma, Vishnu, Shiva, Devi, Krishna, Lakshmi, and Saraswati. They are the laws of God of the Bible. That’s very different.

Explaining the difference, while faith in the Holy Trinity led the American founders to endorse the principle, “All men are created equal,” Hindus, faithful toward a different set of beliefs, profess that Brahma created men to live within a caste system in which the social hierarchy is determined by birth and by name, to the extent that certain individuals are so inferior as to be untouchable by even the lowest caste. Furthermore, Ramaswamy is a Brahman, the highest caste in the Hindu social hierarchy. According to New Yorker Magazine,

Shortly after Ramaswamy was born, his family commissioned his horoscope (which according to God of the Bible is a sin), which predicted that he was destined for greatness. He would later say that his family bestowed on him, their firstborn, a sense of “deep-seated superiority” and an expectation that he would outperform the “average mediocre Joes” with whom he went to school.

Thus, Vivek Ramaswamy is a walking, talking contradiction. He admits a sense of deep-seated superiority to average people, while claiming the principles of the Declaration of Independence, proclaiming equality among all, to be his own. In his pronouncements, he subverts the American founding, transforming its meaning to better fit his personal world view, and in the process co-opting unknowledgeable Christians to agree with his interpretation, and perhaps providing a more acceptable, generic view of the American principles to those who are not of Christian faith. That’s all very clever, but also very dishonest.

On another issue, in a recent online interview Vivek Ramaswamy displayed full ignorance of the problem of US debt, as well as any real solution, claiming simply, “The printing of money happens at the US Treasury.” But the US Treasury does not print money at all. The US Treasury does not create money in any form or fashion. And that is precisely the problem with the debt and our continued government deficits. The US Treasury only creates DEBT, saddling it on the backs of the American people, debt which is used as collateral on the balance sheet of the New York Regional Federal Reserve Bank in a process by which private Wall Street banks loan money into existence, collateralized by future American tax proceeds. The entire US money supply is paying interest to those banks. Precisely because the US Treasury DOES NOT “print money,” as opposed to what Ramaswamy believes, is the reason for the accumulation of unpayable public and private American debt.

So even if one is drawn to the presidential candidacy of Vivek Ramaswamy, please know that there is nothing he might do to remedy the problem of US debt, understanding money-creation process as he does.

Conclusion

When I began my examination of presidential candidate Vivek Ramaswamy, because he was such a long shot, I tended to believe he was being put up to it by certain others interested in diluting Donald Trump’s support, as so many in the Republican field of candidates have been. I figured he was likely just another ‘controlled opposition’ candidate. But what I discovered is an extremely complex individual, flawed like anyone else, whose motivations are not necessarily as advertised. Vivek Ramaswamy has successfully branded himself a young, brilliant executive worthy of the office of President of the United States. He has done so by creating company after company, leveraging their resources in ways to create and exploit opportunities for his own enrichment. While his companies rarely make money, Vivek does. While this young man has made a modest fortune by today’s standards, he appears to have made it on the backs of investors who have themselves lost money investing in his companies. Vivek Ramaswamy is a born salesman, well-spoken, using his communication skills to convince others to do as he directs and to have confidence that he knows what he is doing, when, apparently, he does not. Generally, Vivek Ramaswamy business ventures fail, or at best languish. Now and then (although it has been quite a while) he hits a home run, which feeds the story he uses to convince each next set of investors.

Should we elect the Vivek Ramaswamy media personality, with all his strengths and weaknesses, and place him in the Oval Office as President of the United States, would he be better than with Joe Biden? Perhaps. But the Vivek Ramaswamy personality I see is inward-focused. What he does is for him, not anyone else, not the American people. That is because the welfare of the American people is not what rewards him. Excitement rewards him, he admits that. Moving forward to the next unknown experience rewards him, we see that in his history. Risk excites him, we see that in his history. Downplaying risk to others, while gaining and capitalizing on their trust, rewards him financially, we see that in his history as well.

So, in the end do you want Vivek Ramaswamy to be your next President? I don’t think you are going to have to worry about it, I just thought you ought to know.

I ve been around the block, a coupe times actually. This well researched factual political commentary is one of the best I ve ever read. I d like you to come back on HighNoon and discuss this.

While my judgment of this individual was negative early on, when I got to the internship at the Marksist Goldman Sachs little else was needed for me to cancel his candidacy.

Brilliant article warning us to be more discerning when we support a political candidate.