Modern Money Mechanics- the Fed’s Guideline for Money Creation and Global Control

Continuing with my exposition of the Federal Reserve System, in this Substack you will find screen shots of the damning money creation process published by the Chicago Fed in its booklet, 'Modern Money Mechanics.'

As I have said for years now, the government does not create money. The government only creates DEBT, which is then handed to the Fed as collateral for new dollars printed out of the air. The US Treasury could just as easily create the money in house, debt free, but chooses not to. That one fact should tell you who really runs the US Government.

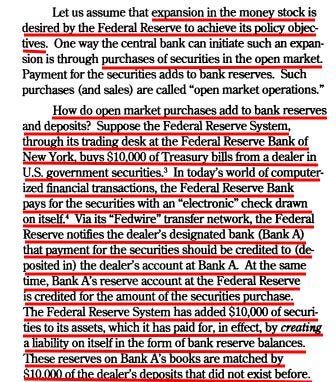

The original transaction in the money creation process is handled by the Federal Reserve Regional Bank of New York. The NY Fed will purchase, for example, a $10,000 Treasury bond, account for that bond as an asset on its balance sheet, and in turn issue 10,000 brand new, never before circulated dollars, entering them as a liability on the Fed’s balance sheet. So you see, THERE IS NO EQUITY IN THE SYSTEM, only assets and liabilities. Money is not loaned out of EQUITY. It is a product of DEBT, even to the NY Fed. Yes, even the Fed has to pay these new dollars back when the loans corresponding to the original transactions are satisfied. Who does the Fed pay? The Fed pays freaking air, friends. When dollars are created they come into existence FROM THE AIR...in other words from NOTHING! And when they are paid back, those dollars go back to where they originally came, again, to the AIR! When that happens, the asset in the form of government debt is credited (reversing the original money-creation transaction), and the liability in the form of dollars in circulation is debited (reversing the original money-creation transaction) zeroing out both the dollars, and the debt, originally created in both accounts.

Because there is no financial equity in the entire system, there is only the IMAGE of financial equity on the books of banks operating within the system. By ‘financial equity,’ I mean equity directly attributable to the ownership of dollars. There is no financial equity in the overall economy, only the IMAGE of financial equity on the books of those who happen to possess more dollars than they owe. Balancing those books, however, are just as many parties who owe more dollars than they possess, creating negative financial equity to balance against any positive financial equity, netting to zero financial equity in the entire US economy. (Here I do not account for interest charged against the entire money supply, which actually results in negative financial equity in the American economy, which at this writing is over $96 trillion.)

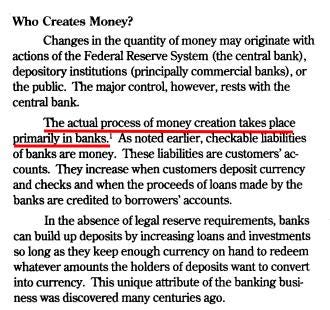

As MMM informs us, money creation takes place in member banks of the Federal Reserve System, not the government. Those dollars are loaned into existence, at interest. Thus, as I have said many times, our entire money supply is paying interest to the member banks of the Federal Reserve System. This process, not government spending per se, is the reason for the national debt, both public and private. Debt is unavoidable under this system. Debt is the very substance of the system! Without the continuous, increasing accrual of government debt, the system cannot operate.

The Process of Dollar Creation

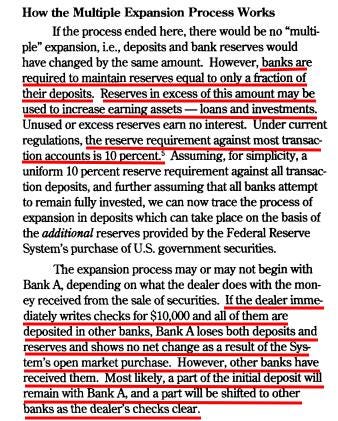

Consider the following passage from Modern Money Mechanics:

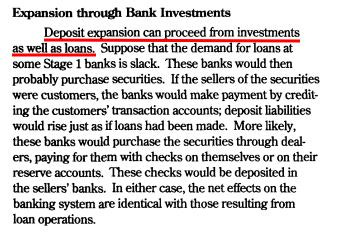

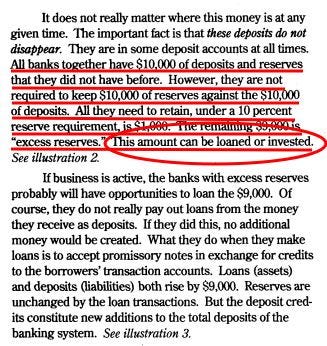

Thus, when new dollars are loaned by Bank A, collateralized by Bank A's reserves, generally they are deposited into an account at a different bank, say Bank B, a transaction which as a result creates new "bank reserves" at Bank B. Bank B is then entitled to create brand new dollars and either loan them into the economy, or, as we will see below, INVEST THEM.

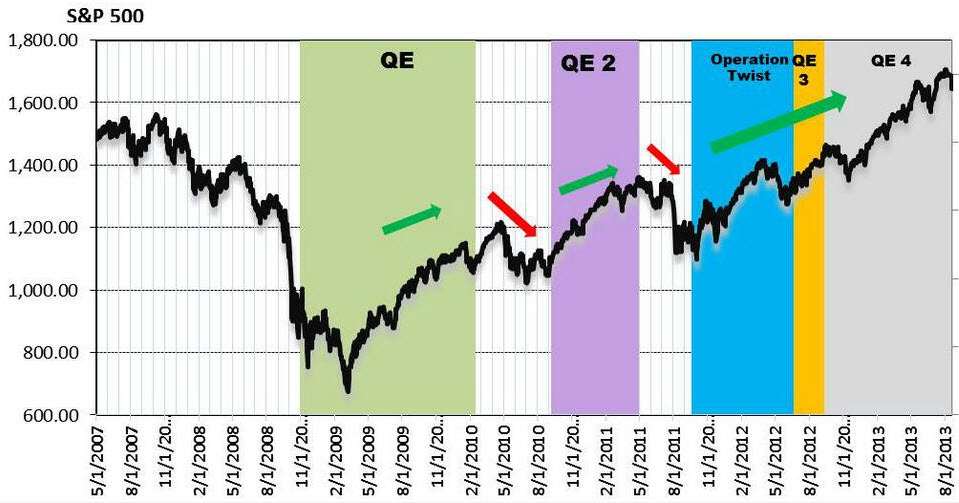

So here we have a private banking system which can create its own investment capital to, for example, bid up stock markets. You will remember the term, ‘quantitative easing.’ That was a procedure in which the Federal Reserve Board in Washington DC eased the rules governing money creation, providing additional liquidity for Wall Street banks. The banks, in turn, created brand new dollars out of thin air and invested them in the stock markets, causing meteoric rises in stock prices and massive financial gains each time.

With each stock transaction, there is a winner and a loser. QE created the means for Wall Street banks to legally manipulate entire stock markets, knowing the profitable results in advance.

So you see, this system is a shell game. One bank creates new dollars based upon its reserves. Those new dollars become reserves for other banks to do the same thing. Using the ability to create money out of the air, Wall Street banks can make the American economy jump back-flips.

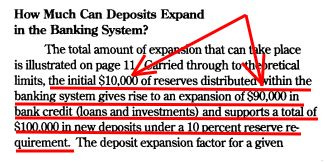

In the end the purchase of one $10,000 government bond can serve as the collateral for the system to create 90,000 brand new dollars, either loaned into the economy, or invested by the banks in stock markets, leveraging the American financial system in ways that require continuous new currency creation, which requires the government to create continuous new debt, backed by the American people, to serve as collateral. In the end, what you have is exactly what we see--out of control government spending and borrowing, for the most outrageous projects like, for example, the war in Ukraine. There is no better way to create more and more new dollars than to use them to buy things that blow up, creating the need to buy more of them in replacement. The more the US Government borrows and spends, the more wealth the US Government covertly transfers from the American people, using the US Treasury as the money-laundering agent, to the banks of the Federal Reserve.

System Cannot Go Forever

At some point, the system described in Modern Money Mechanics will arrive at it's useful end. They know that. After abusing the money-creation processes for its own purposes for 110 years, transferring the wealth of the American people to the Federal Reserve banks of Wall Street, the system will, and has ceased the ability to return the same profits of the past. That means the financial masters running the system will need more slaves to work on the American plantation. That means opening the borders to millions of illegal immigrants. That means flooding the economy with currency at low interest rates and allowing member banks to pull profits not from making loans, but instead from stock market gains. The banks bid up the markets, sell their holdings to declare timely profits, creating boom and bust cycles in the process.

In Davos in 2020, President Trump addressed the World Economic Forum knowing what they have in mind is utterly destroying the United States sovereign entity and replacing it with a private globalist system of governance, basing its new political system on socialist philosophy and communist control systems. Responding to their purpose, Trump informed the WEF:

"We will never let radical socialists destroy our economy, wreck our country, or eradicate our liberty. America will always be the proud, strong, and unyielding bastion of freedom."

Globalism is about the control of money (currency) and resources. Whoever controls the world’s money, controls the world’s resources. Whoever controls the world’s resources, controls the world and everyone in it. Global governance depends on the reality of private control over the issuance of currency, worldwide. That is what free people must prevent.

You Are A Soldier in the War for the World

Like it or not, you are a soldier in a war for the world. Perhaps you now better understand the war you are forced by circumstances to fight. This war is for all the marbles, a war which will decide the future of mankind, whether men will be free, or live and die as slaves under perpetual, global tyranny. No matter what your place and position in life, this war is about you, your family, your progeny, and about a grand experiment undertaken almost 250 years ago in Philadelphia. Will that experiment finally fail, or will it continue, and be handed to the next generation of Americans for safe-keeping. That is the great question before us today. I write these articles so you can better understand the nature of the struggle. You have a say in the final outcome. The more you know, the more effective warrior you become.

Thanking you again for this post, further explaining how we got into this mess.

Again, this post and the other one is a slimmed down version of your presentation on the Fed and how this pernicious octopus infects us all.

Based on your last paragraph, I do take on the challenge to be a warrior for the truth and justice for all. I do what I can, knowing as Tip O'Neil said: “All politics is local."

Had a great visit last night with Mallory Staples and when I mentioned you to her, she said: "I just got a text from Hank."

Thanks Hank. I am beginning to understand this. My husband and I have taken the challenge and are ready to not look back, never stop fighting, learn as much as we can and help save our country! Appreciate your work to help educate us.