The "Raising the Debt Limit" Debate is a Farce

Reverse the accounting entry of money creation, the national debt is paid

It matters not whether your representative cast a symbolic vote against raising the debt limit, or a practical vote raising it, either way, the ultimate effect is meaningless. None of this conversation is meaningful, from either perspective. It is a play fight, a theatrical production, balkanizing the American people in the process, diverting their attention away from the real issue, the real source of American debt, and driving the American people into opposing camps.

So, enough of this talk about raising the debt limit already! The national debt is simply another scam on the American people, and I will prove it to you. By taking part in this meaningless debate, your congressperson, whether he or she even knows it, is helping to obscure the real source of America’s debt, such that the issue can never be resolved.

So please, sit down for a couple of minutes. Lend me your mind and allow me to explain how it is that the US national debt, which this morning added up to over $32 trillion, results from a simple accounting entry, the initial transaction creating a Federal Reserve dollar. As the result of that simple accounting entry, a dollar springs into existence out of absolutely nothing. Once I explain that accounting entry, I will show you that were the accounting entry to create a dollar reversed from the outset, which could still be done at any time, the massive debt America suffers under today, would never have accrued in the first place. Should the accounting of money-creation be reversed, even at this late date, the national debt would begin to shrink. It's just basic double-entry book-keeping, debits and credits. That’s all it is.

So let's look at the two necessary accounting entries for the creation of Federal Reserve dollars handed over from the Fed to the US Government, one entry made at the US Treasury and the other at the New York Fed. All you need to know is that in standard accounting, a DEBIT simply means funds flow TO a particular account. Conversely, a CREDIT means funds flow FROM a particular account. So, for example, if you borrow $1000 FROM the bank, those funds flow TO your personal cash account, meaning you would DEBIT the asset called, "cash." You would then CREDIT "bank loans payable," a liability account, to balance the transaction. Really simple.

Now, there are middlemen in all of this, such as Goldman Sachs, which is what they call a primary dealer for US securities. But keeping this simple, forgetting the middlemen, just dealing with the principles at each end of the transaction, when the US Government wants to receive brand new cash from the Fed, there are corresponding debits and credits it must enter on its balance sheet, just like when you borrow money from the bank and enter it into your checkbook.

Let’s say we want to create $10,000 and place it into an account of the US Treasury. Assuming all this happens simultaneously, the US Treasury issues a bond, which is a debt instrument, a liability, indebting the US Government to pay back $10,000 to whoever holds the bond. In our case, the New York Regional Federal Reserve Bank, which is privately owned by Wall Street banks, will purchase that bond and hold it as collateral. To proceed with the transaction, the US treasury sends the bond over to the Fed.

Next, let's look at the New York Fed's side of the transaction. Remember, until the US Treasury issues that bond indebting the US Government, and hands it over to to the NY Fed, no new cash materializes. But as soon as the NY Fed receives that bond, it debits an ASSET account called, "US Treasury Securities." At that point, a very interesting entry is made as a balancing offset. The corresponding credit entry is to a LIABILITY account called, "Currency in Circulation." Try to wrap your mind around that one for a minute. One might expect that if the Fed loaned some of its precious currency into circulation, and if the Fed is part of the government, then that currency would represent equity, owned by the government, would it not? Well, its not. First of all, the NY Fed is not part of the government. The NY Fed is privately owned, as I said, by Wall Street Banks. And secondly, once the debt of the US Government is paid, even the NY Fed has to pay those dollars back from where they came. The natural question would be, to whom would the NY Fed write a check to pay back those dollars?

The Fed would effectively write a check made out to, "the air." The money came FROM the air, even though the Fed calls "the air" by a different name, "Currency in circulation." So when the US Treasury satisfies that bond and pays it off, the "US Treasury Security," held by the Fed as an asset, disappears and so does the liability, "currency in circulation." The accounting entries to pay off those dollars are the reverse of what I described above. The asset is CREDITED, reversing the original entry and wiping it out to zero, and the liability is DEBITED, reversing the same entry wiping it out to zero. At that point, we find ourselves right back where we started before any currency was issued by the Fed, or debt issued by the US Treasury. Ashes to ashes, dust to dust.

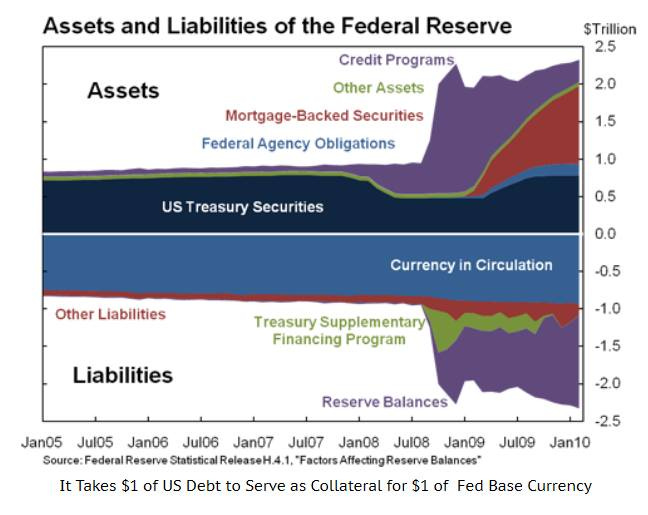

You can see this graphically in the image of the Fed's balance sheet below. Assets are above the line and liabilities are below the line.

Notice, THERE IS NO EQUITY IN THE ENTIRE SYSTEM. Did the NY Fed actually OWN the dollars it placed into circulation? No. Even the Fed had to pay those dollars back to the air from whence it originally materialized. Do you see a Federal Reserve “equity” account? Of course not. An equity account, if it existed, would be "below the line." So because there is no equity anywhere to be found, nobody OWNS anything in this entire system.

What I just described is not a national monetary system. It is a DEBT-BASED PRIVATE ACCOUNTING SYSTEM. The only reason the dollars it generates are regarded legal tender is because the law says they are. As it turns out, all that needs to happen to begin paying this $32 trillion monster off is to

CHANGE THE VERY FIRST ACCOUNTING ENTRY IN THE CREATION OF DOLLARS;

PERFORM THAT TRANSACTION SOLELY AT THE US TREASURY, THUS

ISSUING NEW DOLLARS AS EQUITY FROM THE US TREASURY, RATHER THAN DEBT FROM THE NY FED.

If the US Treasury, rather than the Federal Reserve private accounting system, creates new dollars and issues them into circulation, the US Treasury would debit as asset called, "CURRENCY IN CIRCULATION," but credit as equity account, maybe calling it, "PEOPLE'S EQUITY." There would be NO DEBT associated with the creation of dollars in the system I just described. Instead of a liability below the line, “currency in circulation” would be an asset above the line, and the US Treasury would credit an equity account below the line. That means the American people, as a whole, would actually own the American money supply as a national asset, interest-free, as most people believe anyway, as opposed to the entire system basing itself on the issuance of debt out of the air by both the US Government and the private Federal Reserve accounting system.

And this very simple accounting change in the American money-creation process is what I expect President Trump would accomplish in his second term. That is what the establishment fears most from a second Trump term.

So congratulations! If you made it to this point in the discussion and are still with me, whether you understand it perfectly or not, you are in the 99th percentile of individuals who know anything at all about why the US Government is $32 trillion in debt, and how that debt can actually be paid. The national debt is illegitimate. It’s an accounting trick, a scam, that’s all. The government debt could be paid without bothering to tell the American people. Were the accounting of money creation reversed, the national debt would immediately begin to recede. The world would think it as a financial miracle!

But I will guarantee you one thing, Wall Street banks would know it immediately. You see, the accounting I just described is only the first step in the creation of the US money supply. The next steps are handled by Wall Street banks, effectively a cartel, the members of which are allowed by law to use government debt as collateral to leverage the creation of 9 times the amount of US debt they hold. As a result, the entire US money supply is issued by Wall Street banks, and the holders are paying interest to those same banks. Ever wondered how Wall Street banks got to be too-big-to-fail? Wonder no more. If the accounting of money creation were reversed as I describe, the interest Wall Street banks have been collecting on the US money supply for the past 100 years would be diverted to pay the cost of government, which would automatically pay off the debt. Thus, the perceived need of collecting income tax from the American people, just to pay the government portion of interest, would go away…forever.

The biggest scam in the history of mankind operates by the use of a simple scheme of double-entry book-keeping in which dollars are created as liabilities rather than assets by the Federal Reserve. Reverse that scheme, creating the very same dollars as assets rather than liabilities, performing that accounting function at the US Treasury rather than the Fed, and the national debt immediately begins to be paid down. That’s how you do it. That’s the only way to do it.

So maybe you are beginning to see the “raising the debt limit” debate as the farce it really is. Money-creation accounting is purposely designed to indebt the American people, using the US Government as the go-between to transfer their wealth, as they earn it, to the private banks of the Federal Reserve system as a normal, course of daily events. That said, at least we won’t have to listen to the “raising the debt limit” nonsense for another two years. By then, we could be living in a Brave New World.

Finally, here are some facts for you to consider:

Fact: our entire money supply is borrowed at interest from private banks of the Federal Reserve system. Source: Modern Money Mechanics published by the Chicago Fed, which I have cited many times.

Fact: Since the money supply is loaned at interest into circulation, and no dollars are issued to pay the interest, the only way to pay the interest is to borrow more dollars.

Fact: a growing economy must have a growing money supply.

Fact: a growing money supply requires growing borrowing of dollars.

Fact: the US Government is the largest single source of domestic borrowing of new dollars and spending them into circulation.

Fact: the federal government will borrow over $1 trillion more than it receives this year.

Fact: the Banks of the Federal Reserve are the largest single source of US Treasury purchases, issuing new dollars in exchange for US bonded indebtedness.

Fact: unless those new dollars are issued, they do not exist.

Fact if those dollars do not exist, the government cannot pay them into circulation.

Fact: if those dollars are not paid into circulation, the dollars removed from circulation rival and outnumber those placed into circulation.

Fact: when more dollars are removed from circulation than are added, the economy falls into recession, then depression, which was the cause of the Great Depression.

Finally, until the Federal Reserve system is discontinued, the ownership of the currency restored to the American people through the US Treasury Department, and thus issued by the government debt-free, any successful attempt to cut federal borrowing and spending will cause the economy to fail.

Hi Hank. This very interesting. I have read through multiple times and am still struggling to understand. A picture of the money creation would help. I am having trouble keeping all the parts in my mind as I try to follow what you are saying. I sense the scam but can’t articulate it. 😊

Way to go, Hank and thanking you for a slimmed down version of your presentation on this whole issue…

Once again, you nailed it and painted it shut!!!