The Federal Reserve is Stuck

This is the fourth in a series designed to dispel myths about the US national debt, such as the myth that it is caused by government overspending. It’s not.

In the first article, we talked about why President Trump doesn’t refer to balancing the budget, or paying off the national debt. Trump knows that while the Federal Reserve system remains in charge of issuing America’s money supply, doing so is mathematically impossible. Trump doesn’t talk about things that are impossible, only things that are possible.

Next we learned the big secret nobody will admit, and which proves what I just told you. Before a Fed bank, such as the New York Fed, can issue a new dollar into the economy, the U.S. Government must transfer to the Fed a dollar’s worth of U.S. debt, serving as collateral, indebting the American people to pay the Fed’s dollar back. Once that dollar of debt is received, the New York Fed can electronically deposit a corresponding new dollar into an account in a Fed member bank. From there, the member bank, say, Goldman Sachs, can multiply that deposit by nine and loan or invest the result. That’s how the system works.

So new dollars are always being borrowed into circulation from Fed banks while old dollars are removed, the loans associated with them paid off, a sort currency ebb and flow.

Economic growth requires a growing money supply. That only makes sense. But as I showed you, a growing money supply requires growing U.S. debt. So, if the U.S. Treasury does not pile more and more new debt onto the taxpayers, the Fed will issue no more new dollars.

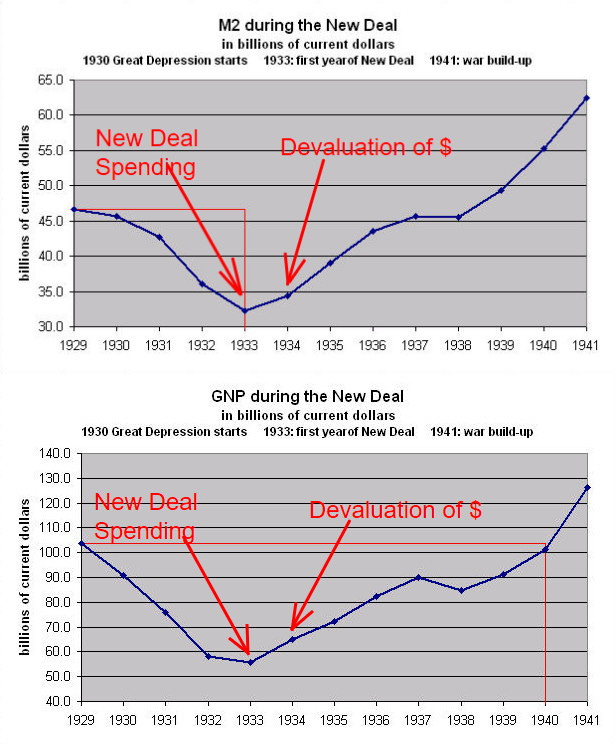

Consequently, should Congress successfully balance the U.S. budget, ensuring that no new dollars enter circulation from government borrowing, as existing dollars are removed as loans are paid off, the U.S. money supply would shrink, causing a recession. And if nothing changes a depression would follow, which is what happened during the 1930’s. The Great Depression is really pretty simple. After the banking binge of the roaring twenties, the resulting bubble burst, loans couldn’t be paid back, the money supply shrank leaving insufficient dollars in circulation to support the economy. That’s it. No big mystery here. My mom once told me about growing up during the Depression, “Son, nobody had any money.” Well, that’s why.

That brings us to last week when we discovered that stock markets have a built-in bias upward. That is because when dollars are initially created and deposited into accounts of a Fed member bank like Goldman Sachs, Goldman can multiply those new-dollar deposits by a factor of nine and either loan out the nine, or very strategically, invest them. So there is a direct link between growth of U.S. debt, growth of the U.S. money supply, and rising stock prices. The result is that banks get richer, government goes deeper in debt, people get taxed more, dollar value decreases, and Americans work their entire lives never knowing their wealth is being siphoned every day by the operators of the Federal Reserve in cooperation with the U.S. Treasury.

Last week we also talked about the 2008-9 financial crisis, TARP and a process Fed Chair Ben Bernanke coined, “Quantitative Easing.,” QE was a process by which Bernanke’s central bank in Washington D.C. issued brand-new dollars at a clip of $85 billion per month, about half going to Wall Street banks, relieving bank stress with much-needed liquidity, the other half going to the U.S. Treasury, exchanging new dollars for new U.S. debt to keep the government solvent. The effect of QE was to enlarge the money supply to fuel the American economy while keeping the banks and government open for business. And as usual, the banks could multiply their QE deposits by a factor of nine, loan a portion and use the rest to bid up stock prices. BTW, that is how you spell, B-U-B-B-L-E.

And as a result of QE, Bernanke’s central bank balance sheet, normally registering in the mere hundreds of billions, ballooned up to $4 trillion. That figure actually equates to many more new dollars in circulation because, again, the banks could multiply their QE deposits by a factor of nine. Presently there are $14 trillion in circulation. $5 trillion, conservatively, are from QE. So if the Fed lowers its balance sheet by X, many more dollars than X would be retired from circulation. That would leave the economy wanting for dollars in a major way, causing a recession. Trump has repeatedly warned the Fed against “balance sheet tightening” for that reason.

So why does the Fed care whether it carries a large balance sheet? Simple, the trillions in circulation associated with QE are not earning the banks any interest. The banks want the Fed’s balance sheet lowered so that replacement dollars from Wall Street banks can earn profits. But the Fed can’t do that for several reasons. First, much of the balance sheet is attributed to bad debt the Fed bought from the banks for cash. Which banks want their bad debt back? Secondly, over $2 trillion is in U.S. debt. Were the Fed to “fire sale” those bonds, yields would increase dramatically, quickly elevating interest rates, leaving the cost of U.S. Government operations unsupportable. So in effect, the Fed is stuck. It manufactured all those dollars to save the banks, the government and the economy, and it can’t take them back. Even so, another round of QE rapidly approaches.