The Dollars and Sense of Disaster Relief

Checked the price of lumber lately? It is out of sight, friends. And the pundits have been saying the building industry is dead. Really? Okay, granted, a couple of “largest hurricanes ever,” making direct hits on major population centers, occupied by millions of inhabitants, their homes, local businesses and elements of vital infrastructure severely damaged or completely destroyed, all within two weeks, does generate a little demand for building materials, and the services to install them. That’s the old supply and demand curve at work. Nothing wrong with that.

Regarding the flooding in Texas, the damage estimates I’m reading range from $150-180 billion. As I write, and as Irma slashes its way northward, the estimates run from $49 to $200 billion. So let’s just assume that the costs of these hurricanes will end up northward of a quarter of a trillion dollars or so. Question: Where will the dollars to pay those costs come from?

Insurance companies? Well, maybe some. But normally, insured losses in these kinds total only to 40-50%. And the damage from Harvey was largely due to flooding, which homeowner’s or business insurance policies won’t cover. The conservatives and the libertarians online keep saying that the people in Texas should have been responsible enough to carry flood insurance. Really? During Harvey, the downtown Houston interstate highways were under twenty feet of water. That was high ground, not identified on any FEMA maps as susceptible to flooding. Harvey was a 500-year storm. Our country is not even 500 years old. So it is not reasonable to expect that the people flooded out by Harvey should have been able to foresee the possibility that their homes and businesses would have been under several feet of water.

But for argument’s sake, let’s just say that the inhabitants near the Texas coast received a message from God urging them to purchase flood insurance. Those kinds of dollars are not available from any flood insurance programs backed by the US Government anyway, much less any private insurers. Were private insurers and re-insurers actually on the hook for Harvey flooding, they would simply bankrupt leaving the victims back at square one regardless. So flood insurance, for an event like Harvey, would not be the answer. Once again I ask, where might the dollars come from? Who in the US economy even has the dollars necessary to repair this kind of damage? Let’s look.

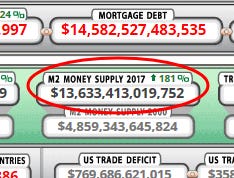

Presently, circulating within the US economy, paying for all the everyday stuff that makes up our GDP, is about $13.6 trillion. That’s $42,500 in circulation, per capita, supporting the varied lifestyles of every person in America, all the businesses, etc. Now if the damage might cost, say, $300 billion, that comes out to almost $1000 dollars for each man, woman and child. That’s $4000 for a family of four. Americans are a charitable people, and while they will give what they can to help others, my sense is that Americans are not ready, willing or able to donate personal dollars, in this magnitude, to relieve the victims of these disasters. Looking to the government won’t help either. I just checked; the US Treasury only has $55 billion cash on hand to pay all its bills. Florida’s hurricane relief fund only has $17 billion. The insurance companies don’t have it.

And so obviously additional dollars beyond those presently circulating will be necessary to generate the economic spending power required to pay the damage from these two hurricanes. Where will those dollars really come from? That’s right, friends, Wall Street banks.

But how would even those banks come up with $300 billion, or more, in cash, to loan out to pay for all that damage? Look up; what do you see? The sky? Breath deep; what do you inhale? The air? That’s it, friends; the sky and the air are from where Wall Street banks of the Federal Reserve System will get the dollars, which they will loan at interest to the US Government and to private parties to pay the relief costs from these storms. Wall Street banks, at virtually no risk, will profit, while the American people suffer and while their government goes deeper into debt, the bankers' largest cost being to pay technicians to create new dollars on computer screens.

Now if this is the system that will finance the repairs from these natural disasters, and it is, then why would not Wall Street bankers excite at the prospect of these kinds of storms and other natural disasters visiting as well? What about man-made disasters? Is that possible? What about war? How morally bankrupt is a system in which private bankers can print money from the air, loan it to various world governments to war with one other, creating a demand for dollars to purchase more and more weapons, manufactured by corporations financed by those same Wall Street banks, who then loan even more “air” dollars to the US Government, which sends them out as foreign aid, to pay the cost of repairing all that war damage?

The system I describe could only exist if those who represent you in DC allow it to exist. The answer? Replace them all in 2018.