Fed Inflation Target-A Mask for Theft

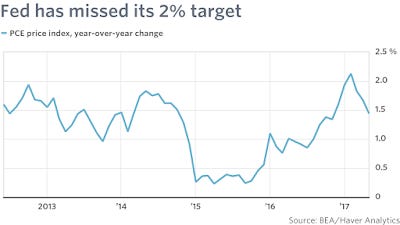

If you pay attention to these things, you know that last week the Fed missed its “2% inflation target” once again. But have you ever stopped to wonder why the Federal Reserve wants inflation? Let’s examine the Fed’s so-called, “2% inflation target,” and understand what it is really all about.

Since 1913 the Fed’s policies have caused the US dollar to lose 95% of its value. And the central bank's oft-stated purpose is to inflate the currency even more. Were the Fed to achieve its 2% inflation target, over ten years that would mean that your money would be worth 22% less than today. If met for 20 years, that figure would rise to 49%. That means that on average your cost of living would go up by that same amount. Now think about that for a moment. If it costs each American 49% more to live 20 years from now, living the same livelihood they do today, that means that there must be at least 49% more dollars circulating in 20 years to pay those same costs. Are you getting this? That $13.6 trillion in circulation today would have to become $20 trillion. I submit to you that buying power, per dollar, due to “Federal reserve inflation,” is not simply lost, as if gone to “money Heaven.” Instead it is purposely and covertly transferred…to the Fed banks, mostly those on Wall Street. That is because those banks control the vast amount of currency creation in the US economy. And remember, they only issue currency when there is a promise to pay it back—with interest. That means that virtually the entire US money supply is paying interest to those same banks. The more money in circulation, the more interest the Fed member banks receive. Thus the banks have an economic interest for the money supply to constantly increase.

But it is more than that. To keep the system going, the Federal Reserve banks must loan enough to consistently increase the money supply even faster than the economy grows. That devalues the currency, but places enough "extra" in circulation to keep the economy running, while spinning off enough cash to pay the bankers their interest. When more dollars are issued than the economy can absorb through growth, what happens? That’s right, inflation. And the Fed has calculated that in order for its banks to continue to receive the proper interest owed them, on the entire US money supply mind you, the money supply must increase on average 2% faster than GDP. And that, my friends, is what is under the hood of the Fed’s “2% inflation target.”

What I just described is a wealth transfer system. It operates transparently. You can’t see it. And day to day you do not feel it. But over time this system continually impoverishes the American people and transfers their wealth to the banks of the Federal Reserve. When the officers of the Federal Reserve remind you of their 2% inflation target, they are really telling you that they are targeting 2% of your buying power to take for themselves. Fed inflation is not a normal occurrence in a healthy, free economy. Fed inflation is theft by deception. It is fraud. And your representatives in congress continue to stand silent while the banking system steals from you. I have addressed this issue with both 7thDistrict US Representative Rob Woodall and 9th District Representative Doug Collins, and neither are remotely interested, yet another reason they must be replaced.

But here’s the even bigger problem for the banks and the Fed than simply missing their target: The US economy is saturated with debt, the American people at their borrowing limit. Since the banks have not been able to loan enough to inflate the money supply at a rate that will achieve their target, the dollars necessary to grow the economy are not there. The total US debt (presently $67 trillion), however, keeps growing. If the Fed truly raises interest rates, bank lending dampens even more. So they are stuck. US debt has outstripped the ability for the US economy to pay the bankers their cut. The US economy is hardly growing because most potential economic growth ends up as profits in the coffers of the banks who issue the currency…in the form of interest on the US money supply.

That's right; the Federal Reserve 2% inflation target is really interest revenue on the entire US money supply, payable by the American people to the banks on Wall Street. Based on $13.6 trillion in circulation, that 2% inflation target represents $272 billion that Wall Street banks presently desire to covertly steal from the American people and their government during the next year.

But looming over the horizon is the very real possibility that uncontrollable inflation might occur in the US economy. One by one, as the nations of the world drop the dollar as their chosen vehicle to conduct international transactions (Venezuela just this week), those dollars will migrate back to America. Were those dollars to all come home, the US currency supply would swell by 42%. That means hyperinflation.

The bankers should be careful of what they ask for. They just might receive it.