American Form of Government, Not What You Think

Last week I discussed how the Federal Reserve System, a private, corporate institution, creates dollars, essentially loaning them at interest into circulation for us to use. I explained that because all dollars are loaned at interest, they must be paid back. And I explained that because the system does not issue dollars necessary to pay the interest, the only way to do so is to borrow more dollars and pay the interest on the existing dollars out of new dollars just borrowed.

Importantly, under this system, each dollar of principle paid back to its primary lender is removed from circulation. So were the American people to attempt to pay back $71 trillion they and their government owe, with only $14 trillion in circulation, they would retire every dollar in the money supply and be left with $57 trillion of debt, and no dollars to pay it. That is how the system works. And that is why it is hopeless to cut government spending to balance things out. Cutting spending would mean less dollars borrowed into circulation to replace those removed, forcing America to go broke that much faster.

So the idea of balancing the US budget while the Federal Reserve System remains in operation is a non-starter. US Government borrowing of new dollars and spending them into circulation is the primary means keeping the US economy liquid. Were the US Government to halt borrowing new dollars and spending them into circulation the money supply would contract, throwing America and the world into an unrecoverable depression. Debt can only be paid with equity. Yet there is no equity in this system. When loans are paid off, those dollars are paid back into the air from whence they originated. The bottom line is that as long as the Federal Reserve System is in operation, it is mathematically impossible for America to become anything other than a nation completely incumbered in debt.

And so understanding all that I just shared, today I want to explore a different aspect of this system, which after operating for over 100 years has left the American people over $70 trillion in debt. Today let’s talk about the Federal Reserve Central Bank, the head of the beast I described last week and its relationship to the US Government.

Federal Reserve in Washington DC

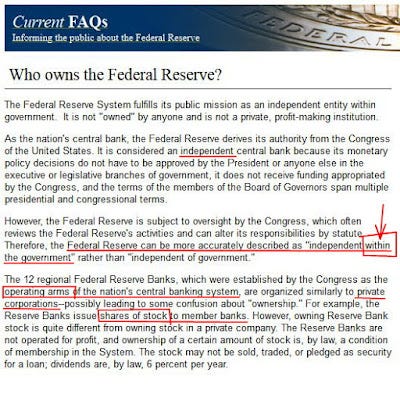

The Central Bank is physically located in Washington DC, situated among various US Government buildings, resembling a government building itself. Even though its name might sound like it is part of the government, and even though its office is situated among government offices, the Federal Reserve Central Bank is not part “of” the government. And the Fed tells us that. In its own words, the Fed is an “independent” institution, one whose decisions are not subject to approval by the US Government. Furthermore, according to the Fed, “the Federal Reserve can be more accurately described as “independent within government” rather than “independent of government.” Pay close attention to what the Fed is saying. The Fed is admitting that it is a non-governmental organization (NGO), however one that exists within the US government. Try to wrap your mind around what that means. The Federal Reserve Central Bank is private. It is independent. Yet that private, independent institution is within the US Government. Now where does the US Constitution allow private institutions to exist “within” the US Government?

You see, what the Fed describes is a form of government foreign to the US Constitution. According to the Constitution, the United States is a republic, a government in which only the people are represented. But under this arrangement, private banks are represented within the people’s government. And so what we have with the Federal Reserve is not just a private institution apart from government. And what we have is not government apart from private institutions. Instead, what we have is a blend, a relationship between the public US Government and a private banking system within. Rather than a republican form of government, as required by the Constitution’s Article IV, Section 4, the US Government operates as one enormous public-private partnership (PPP). But it’s worse than that.

That's because whoever controls the means by which government decides and administers policy is the de facto sovereign. Under this partnership, the Federal Reserve is the private means by which those dollars are created and channeled. And the Fed is unaccountable to government. In effect, because the Fed controls the money, the government is accountable to the Fed. Remember, no audit of the Fed has ever been undertaken. That is because this private institution has the ability to use money to control the members of Congress and even the President. By controlling the American money supply, and remaining unaccountable to the people’s government, over the last 100 years, the Federal Reserve has become the private dictator of American policy, within the US Government.

There is another term to describe this arrangement of governmental operations. That term is, “corporate fascism.” Corporate fascism is a system in which the people’s government, over time, becomes so heavily influenced by corporate interests, interests who have the means necessary to purchase influence at the very highest levels of the people’s government, that the government is for all practical purposes, eventually taken over by those corporate special interests. At that point, the government becomes almost solely a tool of corporate special interests. Is that not what we have seen? The Federal Reserve is a corporate controller of the US Government. In effect, America exists under a private dictatorship, one administered through its banking system.