America, China’s Piggybank

According to President Trump, China has been using America as its own personal piggy bank. Is that true? I ask because on the surface, Americans receive products made cheap overseas in exchange for dollars. That’s a free market, right? Well, no it’s not. But to understand why, ask yourself these questions: Why does China even want US dollars? Why does China hold US dollars in reserve? Why does China buy US Treasuries with its excess dollars? And here is the big question for all Americans, if America exports dollars to China and the world the tune of $800 billion each year, meaning that $800 billion actually exit the fifty states destined for foreign accounts, don’t those dollars have to be replaced? Where do replacement dollars come from? Okay, now we’re thinking. Let’s get some answers.

We can agree that “free trade” requires both sides of a transaction to enter voluntarily, neither side coerced to trade with the other. But that is not what we have here, not really. To answer to our first question above, which asks why China wants all those dollars from America in exchange for its exports, understand that China has very little home-grown energy to power its economy and to feed and house 1.4 billion Chinese. China must therefore purchase the energy it needs on the world market. But to do that, China must possess dollars. Why, you ask? Why doesn’t China trade its own currency, yuan, for energy and offer Chinese exports to the energy-producing countries of the world to receive them back, just like it trades America it’s exports for US dollars?

China cannot do that because the world energy market is not a free market. Instead of trading its own currency for energy on a free and open world energy market, and then equalizing that trade with its own exports to receive them back, China must first go through the step of possessing dollars in its world trading accounts and trade those dollars for the energy it needs. But to obtain dollars, China must sell America a bunch of cheap stuff and send that stuff in exchange.

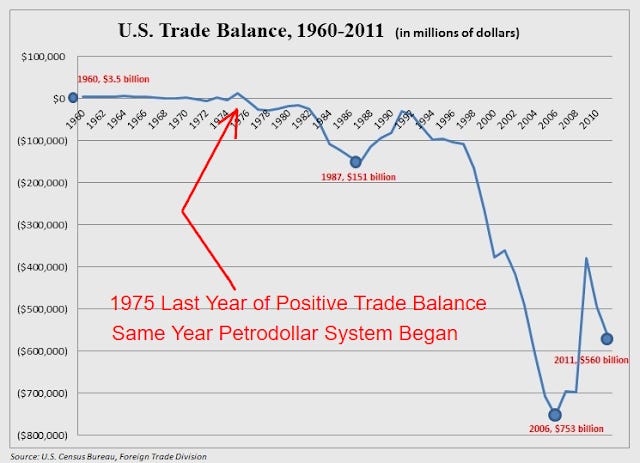

That is because of an agreement among the Saudis, other OPEC countries and the US made long ago in the middle 1970’s. Pursuant to that deal, oil-producing countries such as Saudi Arabia, largely located in the Middle East, agree only to accept dollars in exchange for their oil. Because that agreement is still largely intact, though fading for reasons we won’t go into today, China can’t just trade its products to the Saudis for Chinese yuan. The Saudis do not have yuan to pay for them. China must therefore possess US dollars and use them. The “petrodollar system” as it is known is an insidious arrangement. Everything looks pretty normal from the outside. But underneath it all is intrigue, coercion, dishonest dealing and anything but a free market for goods and services. So, if the energy necessary to produce goods and services is itself not a product obtainable on an open, free market, then the products the derive from the use of that energy are also not those of an open, free market. That is just one reason, on the American side of the ledger, that trade between China and America is not “free trade.” So to answer the first question above, China must have dollars or its production economy will lack resources to operate.

That brings us to the next question, why China buys US Treasury bonds from the US Government. You see, once China has enough dollars in its international accounts to pay for its current world obligations, such as to purchase the energy it needs to power its economy, the rest of its dollars are essentially useless to them. To make use of them, they spend them here in the US. One way to spend them is to buy US Treasuries which helps fund the American Government. Doing so, the Chinese Government at least hopes to make enough of a yield on its excess dollars to pay for a loss of value due to dollar inflation. Another alternative is for China to purchase real US assets on the ground here in America. That is what happened in 2012 when President Obama and Secretary Clinton leased the Long Beach port to China (You don’t think those two received something in return?) Long Beach is the gateway for oriental goods entering America. China has been operating that port. Exerting even more pressure on Chinese President Xi, Trump just rescinded Obama’s lease. The port of Long Beach will once again be operated by the US Government, pressuring Xi even more to cooperate on the US-China trade imbalance.

So if all you knew is what I have laid out so far, you might think a healthy trade deficit with China is a wonderful thing. Americans receive stuff produced in China for less than we can produce it ourselves. All good, right? Here’s the problem. All those dollars leaving America for China and elsewhere must be replaced for our domestic economy to continue to operate, which brings us to the last question above: Where does America get replacement dollars to operate our economy? The answer is, America must borrow those new dollars at interest from the private banks of the Federal Reserve System. We’re talking Wall Street. The US trade deficit is financed by the accumulation of American debt. America’s trade deficit is a debt-creation machine. Trump means to remedy that.